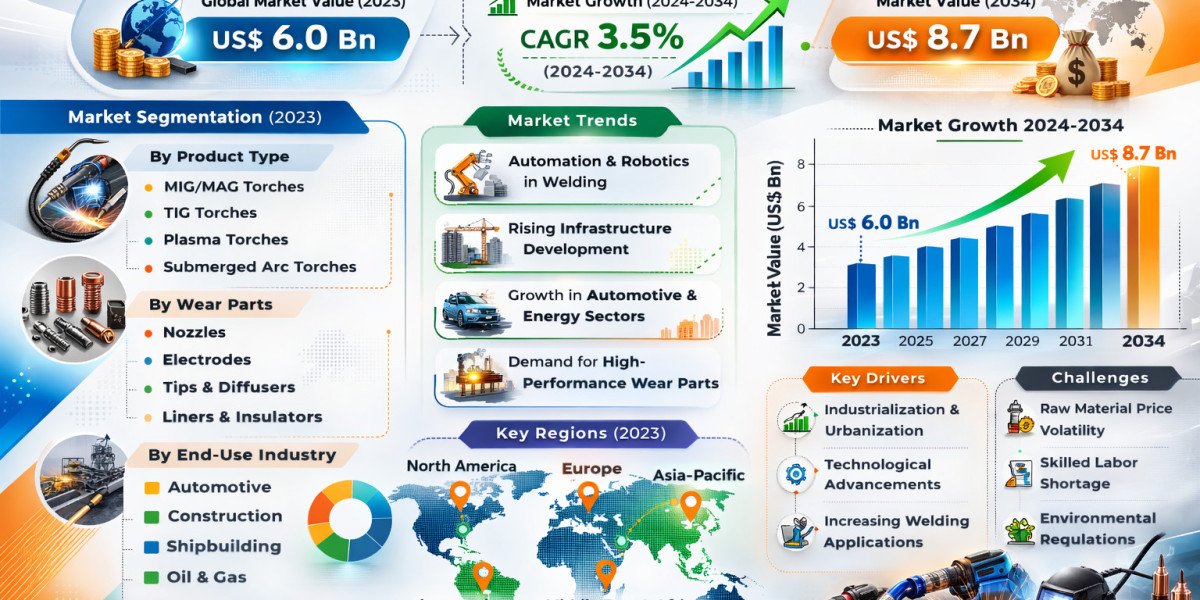

The global Welding Torch & Wear Parts Market is entering a phase of sustained expansion, supported by growing industrial automation, large-scale infrastructure investments, and the accelerating transition toward renewable energy systems. The market, valued at US$ 6.0 Bn in 2023, is projected to reach US$ 8.7 Bn by 2034, expanding at a steady CAGR of 3.5% during the forecast period (2024–2034).

As global industries modernize manufacturing lines and pursue higher efficiency, welding equipment—particularly torches and wear parts—has become increasingly critical. These components are essential to ensure welding precision, reduce downtime, and maintain operational continuity across automotive, aerospace, heavy machinery, and construction sectors.

Understanding Welding Torches & Wear Parts

Welding torches are core tools in the metal joining process. They generate controlled heat through flame or electric arc to melt and fuse metals. Various types of welding torches are designed to meet specific industrial needs:

MIG/MAG (Metal Inert Gas/Metal Active Gas) – Ideal for high-speed industrial applications.

TIG (Tungsten Inert Gas) – Preferred for precision welding in aerospace and specialized fabrication.

Plasma Torches – Used for high-temperature cutting and welding operations.

Wear parts are consumable components that degrade over time due to exposure to intense heat, mechanical stress, and oxidation. These include:

Contact tips

Nozzles

Electrodes

Collets

Diffusers

Liners

Because wear parts require frequent replacement, they generate recurring revenue and form a significant share of total market demand.

Market Growth Catalysts

1. Industrial Automation and Robotics Integration

Automation has fundamentally transformed welding operations. Industries are shifting from manual to robotic welding systems to enhance precision, improve worker safety, and increase production speed.

Automated welding lines require:

High-durability torches

Heat-resistant consumables

Precision-engineered wear components

Real-time performance monitoring

The growing adoption of robotic welding in electric vehicle production and smart manufacturing plants is directly boosting demand for advanced welding torches compatible with automated systems.

Robotic systems operate continuously and at high speed, increasing wear rates. As a result, the aftermarket for consumables has become a strong growth segment within the market.

2. Renewable Energy Infrastructure Expansion

The global transition to renewable energy has created substantial demand for welding solutions. Wind turbines, solar panel structures, hydropower installations, and energy storage systems all require extensive welding during construction and maintenance.

Large-scale wind turbine towers require heavy steel welding with high structural integrity standards. Advanced welding torches ensure:

Deep weld penetration

Minimal defects

Corrosion resistance

Long-term mechanical durability

As governments increase clean energy investments, welding equipment manufacturers are benefiting from consistent infrastructure development projects.

3. Construction and Urbanization

Rapid urbanization in emerging economies is driving demand for commercial buildings, bridges, transportation networks, and industrial facilities. Construction projects rely heavily on welding for structural steel assembly.

Regions such as Asia Pacific, particularly China and India, are investing heavily in infrastructure modernization. This drives steady demand for welding torches and replacement wear parts.

4. Growth in Automotive and EV Manufacturing

The automotive industry remains a major consumer of welding equipment. Body-in-white manufacturing, chassis assembly, and battery housing fabrication for electric vehicles require precision welding processes.

As automakers move toward lightweight materials and electric mobility, the need for advanced welding technologies capable of handling aluminum and composite materials is increasing.

Market Segmentation Analysis

By Type

Torch

Wear Part

Wear parts account for recurring revenue due to their consumable nature, while torches represent higher-value equipment purchases.

By Category

MIG/MAG

TIG

Plasma

MIG/MAG systems dominate in mass production industries, while TIG torches are widely used in aerospace and specialized manufacturing environments.

By Cooling Method

Water-Cooled

Gas-Cooled

Water-cooled torches are preferred for heavy-duty applications with high heat loads. Gas-cooled systems are commonly used for light to medium welding operations.

By Mode of Operation

Manual

Automatic

Automatic welding systems are gaining momentum due to industrial automation trends.

By End-Use Industry

Automotive

Construction

Oil & Gas

Heavy Equipment Manufacturing

Demolition & Scrap

Yellow Goods

Others

Heavy equipment manufacturing and oil & gas industries require robust welding systems for thick materials and extreme operational environments.

By Distribution Channel

Online

Offline

Traditional offline distribution networks remain dominant; however, online procurement is expanding due to convenience and price comparison capabilities.

Regional Insights

Asia Pacific – The Market Leader

Asia Pacific leads the Welding Torch & Wear Parts Market in both volume and revenue. Rapid industrialization, strong manufacturing output, and government-backed infrastructure projects are driving growth.

China, the world’s largest steel producer, relies heavily on welding technologies for construction and heavy industries. India’s manufacturing expansion initiatives and infrastructure programs are also contributing to rising demand.

Japan’s advanced manufacturing sector further strengthens the region’s market position.

North America

North America maintains a strong market presence due to technological advancements and automation adoption. The region’s automotive and aerospace industries are major contributors.

Manufacturers in the United States are investing in smart welding systems integrated with IoT and real-time data analytics.

Europe

Europe emphasizes energy efficiency and sustainability. Stringent environmental regulations encourage manufacturers to develop eco-friendly welding consumables and energy-efficient torches.

The region’s strong automotive and renewable energy sectors support steady demand.

Middle East & Africa

Oil & gas infrastructure projects are key demand drivers. Additionally, increasing diversification efforts into manufacturing are gradually expanding welding equipment usage.

South America

Infrastructure projects and mining operations contribute to moderate growth in South America, with Brazil emerging as a key market.

Competitive Landscape

The market features a mix of established multinational companies and regional manufacturers. Leading players are investing in innovation, automation compatibility, and product durability.

Prominent companies include:

Lincoln Electric Holdings, Inc.

Miller Electric Mfg. LLC

ESAB Welding and Cutting Products

Hobart Brothers Company

Panasonic Corporation

Linde plc

Colfax Corporation

Dinse

EWM AG

Fronius International GmbH

These companies focus on:

Expanding product portfolios

Enhancing automation compatibility

Strengthening distribution networks

Increasing R&D investments

Recent Industry Developments

In 2024, Migatronic A/S launched the iMig series, featuring advanced digital controls and energy-efficient performance improvements.

Similarly, Lincoln Electric Holdings, Inc. introduced the VRTEX® 360 virtual reality welding training system to address the skilled labor gap through immersive simulation technology.

These developments reflect the industry’s focus on innovation, digital transformation, and workforce development.

Market Challenges

Despite steady growth, several challenges persist:

Volatile raw material prices

Shortage of skilled welders

Competition from low-cost manufacturers

High capital investment for automated systems

Addressing these challenges requires investment in training programs, product differentiation, and long-term supply chain partnerships.

Emerging Opportunities

The future of the Welding Torch & Wear Parts Market will be shaped by:

Integration of AI in welding process control

Predictive maintenance technologies

Growth of additive manufacturing for wear parts

Increased focus on sustainable materials

Expansion of electric vehicle production

Companies that align with Industry 4.0 principles and sustainability goals are expected to capture greater market share.

Strategic Outlook Through 2034

Over the forecast period, market growth will remain stable but consistent. While the CAGR of 3.5% reflects moderate expansion, the recurring nature of wear part replacements ensures dependable revenue streams.

Automation, renewable energy investments, and industrial modernization will collectively sustain long-term demand. Asia Pacific will continue to dominate, while North America and Europe will focus on technological upgrades and efficiency improvements.

Manufacturers emphasizing digital integration, smart torches, and environmentally sustainable production processes will lead the competitive landscape.